Home Improvement Loans:

Latest data released by Post Office Money shows that homeowners collectively spent £295bn in home renovation in the last 5 years. This led to an increase of £40,000 in the overall property value.

The growth of house prices has slowed down over the past few years. And, therefore, more and more homeowners are getting inclined to the idea of improving their home to add value to their property. Doing so will significantly increase the market value of their home.

Regular upgrades and renovations allow the homeowners to craft homes that echo their necessities and personal taste.

According to the NAEA Propertymark (National Association of Estate Agents), the number of homeowners choosing to invest in their existing property instead of moving out has rocketed in the past five years.

Representative Example: £12,000 over 66 months, 31.9% APR fixed. Monthly payment £358.22 Annual interest rate 28.01% fixed. Interest payable £11,642.52. Total repayable £23,642.52. Representative Example: £12,000 over 66 months, 31.9% APR fixed. Monthly payment £358.22 Annual interest rate 28.01% fixed. Interest payable £11,642.52. Total repayable £23,642.52. Representative Example: Loan Amount: £20950.00, Loan Term: 85 Months, Interest Rate: 23.00% PA Variable. Monthly Repayments: £537.44. Total Amount Repayable: £45,682.15. This example includes a Product Fee of £2,095.00 (10% of the loan amount) and a Lending Fee of £714.00 Representative Example: Loan Amount: £20950.00, Loan Term: 85 Months, Interest Rate: 23.00% PA Variable. Monthly Repayments: £537.44. Total Amount Repayable: £45,682.15. This example includes a Product Fee of £2,095.00 (10% of the loan amount) and a Lending Fee of £714.00 Representative Example: Borrowing £3000 over 36 months with a representative APR of 39.9% (variable),the amount payable would be £134.21 a month,with a total cost of credit of £1831.56 and a total amount payable of £4831.56. Representative Example: Borrowing £3000 over 36 months with a representative APR of 39.9% (variable),the amount payable would be £134.21 a month,with a total cost of credit of £1831.56 and a total amount payable of £4831.56.Maximise your options: Compare and apply for loans below with LoanTube

Apply Filters

Loan Amount

£4000 -

£20000

Norwich Trust

Loan Term

1 -

10 years

4.8/5

Representative APR

31.90%

Minimum Age

21 Years

4.8/5

Norwich Trust

Loan Amount

£4000 -

£20000

Loan Term

1 -

10 years

Representative APR

31.90%

Minimum Age

21 Years

Minimum Income

£2000 per month

Loan Amount

£5000 -

£100000

Evolution Money Loans

Loan Term

1 -

20 years

4.5/5

Representative APR

28.96%

Minimum Age

18 years

4.5/5

Evolution Money Loans

Loan Amount

£5000 -

£100000

Loan Term

1 -

20 years

Representative APR

28.96%

Minimum Age

18 years

Minimum Income

Not mentioned

Loan Amount

£1000 -

£10000

1Plus1 Guarantor Loans

Loan Term

1 -

5 years

4.4/5

Representative APR

39.90%

Minimum Age

18 years

4.4/5

1Plus1 Guarantor Loans

Loan Amount

£1000 -

£10000

Loan Term

1 -

5 years

Representative APR

39.90%

Minimum Age

18 years

Minimum Income

Not mentioned

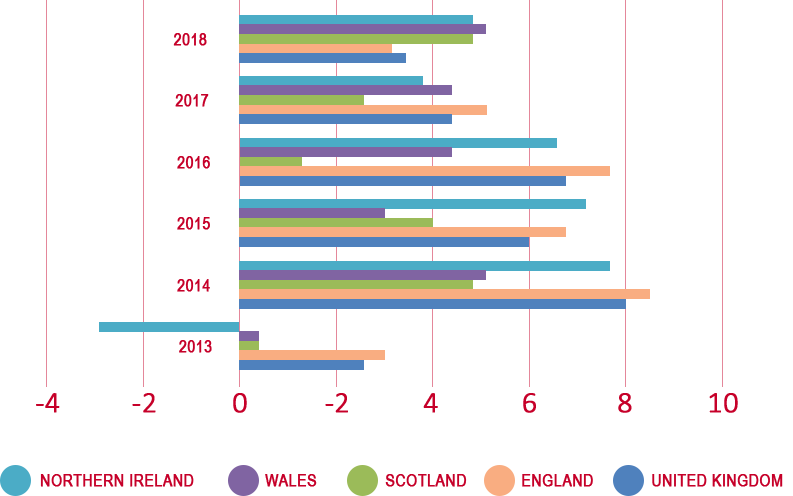

Housing Statistics for January 2019

The average price of a property in the UK was £228,14.

The average price of a property in the UK was £228,14. The annual price change for a property in the UK was 1.7%.

The annual price change for a property in the UK was 1.7%. The monthly price change for a property in the UK was -0.8%.

The monthly price change for a property in the UK was -0.8%. The monthly index figure (January 2015=100) for the UK was 119.7.

The monthly index figure (January 2015=100) for the UK was 119.7.

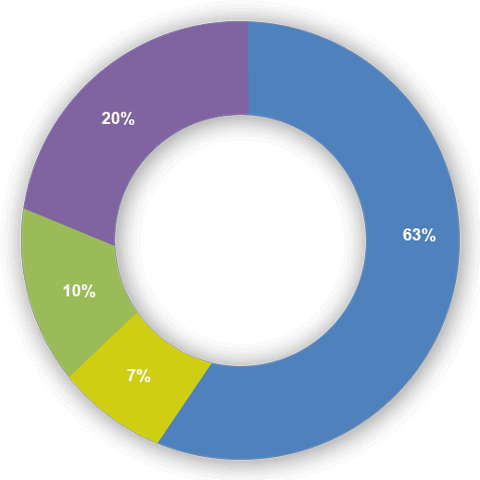

Dwellings by Tenure-2017

- Owner Occupied

- Local Authority

- Housing Association

- Private Rented

House Prices and Brexit

Upgrades and improvements increased the value of the property by £40,000.

Upgrades and improvements increased the value of the property by £40,000. Average value of property changed from £210,000 to £250,000.

Average value of property changed from £210,000 to £250,000. Only 5% of homeowners who did upgrades had the intention of moving.

Only 5% of homeowners who did upgrades had the intention of moving. 28% thought that improvements would increase the overall property value.

28% thought that improvements would increase the overall property value. 59% had a reason of improving their home’s appearance.

59% had a reason of improving their home’s appearance.

Cost of Moving House in 2018

The latest research done by Compare My Move has found that the average UK homeowner spent more than £10k when moving their home. And first-time buyers spend £1,761 on extra moving costs adding 4 months of saving.

There are several benefits of maintaining a good credit score such as having the benefit of being offered a lower interest rate on the loans that one opts for. A good credit score helps an individual to save money on a wide range of services. LoanTube has listed a few tips to help maintain the credit score to be fit and in shape:

Keep paying bills on time. Any bill, if unpaid, could wind up on your credit report.

Refrain from applying for new credit as multiple credit checks also impact the ratings.

Know your credit report inside out. A single error can lead to a drop in the score.

Manage your debt efficiently and responsibly. Lower the debt, higher is the credit score.