Confused between choosing the right type of loan for your financial needs? Read this article to get the clarity and know how loan comparison tool on LoanTube can help. Borrow wisely!!

With so much competition on offer between finance companies wanting to lend borrowers money, how do you choose not only the right company for you but the right type of loan product too?

Maximise your options: Compare and apply for loans below with LoanTube

Apply Filters

In this article, LoanTube considers:

- secured and unsecured loans – how to choose between them,

- how do lenders decide on whether they want to approve your loan application?

- the main reasons behind why people borrow money, and

- how LoanTube can help.

The Two Main Types of Loan

Secured loans

If you take out a secured loan, you pledge to the lender that, if you can’t make the repayments on your loan after defaulting, they can take ownership of something that belongs to you. What you pledge is called your “security”. When they take ownership of your security, they will then sell what you’ve pledged to attempt to recoup the amount you still owe them on your credit facility. The best-known example of a secured loan is a mortgage. However, offering security for a loan is not just restricted to mortgages. Logbook loans use your car as security and pawnbrokers use valuables like jewellery as security.

The more you want to borrow, the likelier you are to be offered a loan if you offer security to the lender. How much and for what type of loan?

| Type of loan | Amount you can borrow | Time to pay it back |

| Bridging loans | £5,000-£250,000,000 | Up to 18 months |

| Debt consolidation loans | £10,000-£25,000,000 | Up to 35 years |

| Personal loans for home improvement | £1,000-£25,000,000 | Up to 25 years |

| Logbook loans | £500-£150,000 | Up to 5 years |

| Vehicle financing | Cost of the car or van | Up to 5 years |

Unsecured loans

Unsecured loans do not require you to pledge any of your assets or possessions to your lender in order to be able to obtain the finance you’re seeking.

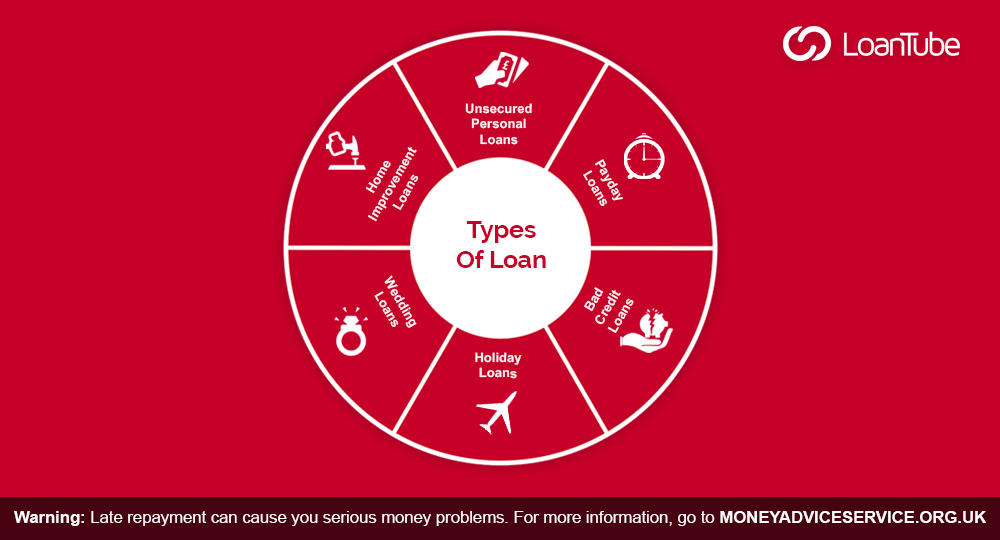

There are seven main types of unsecured lending in the UK offering borrowers the opportunity to borrow the following amounts over the following lengths of time.

| Type of loan | Amount you can borrow | Time to pay it back |

| Bad credit loans | £1,000-£25,000 | 1 year – 5 years |

| Debt consolidation loans | £1,000-£40,000 | 1 year – 10 years |

| Guarantor loans | £1,000-£40,000 | 1 year – 5 years |

| Payday loans | Up to £1,000 | Up to 35 days |

| Peer to peer loans | £1,000-£30,000 | 6 months – 5 years |

| Personal loans | £500-£25,000 | 1 year – 5 years |

| Short-term loans | £500-£2,500 | 2 months – 1 year |

Which should you choose?

Before you make any application for a loan, you should feel confident in yourself of the amount that you could comfortably afford to pay back a lender every month. This is just as important for you as it is for the lender – taking out a loan you can barely afford will mean that, unless you cut back on spending, you will find meeting bills and other spending demands difficult for the period of time during which you’re paying back your loan.

How Does a Lender Decide Whether to Approve your Application for a Loan?

Of course, the amount you can actually borrow depends on a number of different factors, including:

- your current financial situation with specific reference to the amount of disposable income you have a very month,

- what’s contained on your credit report, and

- the stability of income coming into your household.

Many lenders may be happy to work with you however some may say “no” to your application if they feel that you’re borrowing more money than you can comfortably afford to.

For borrowers with poor credit histories, you may want to consider specialist financial products aimed at you including bad credit loans, payday loans, short-term loans (sometimes called instalment loans), guarantor loans, or logbook loans. Borrowers applying for these types of loans should expect to pay a higher rate of interest on the money they borrow.

If you have a strong credit record, you will have a wider range of different types of loans available to you on which you’ll be charged a lower rate of interest. To know how to build your credit score, click here.

What Are the Main Reasons Why People Borrow Money?

There are lots of different reasons why people borrow money. For some people, it’s about having the cash at hand they need to meet an unexpected bill like medical expenses, their boiler breaking down, or the car going into the garage for repairs.

For other people, it might be to fund the purchase of something a lot more expensive like home improvements, a brand new car, or the holiday of a lifetime.

Debt is not bad in and of itself – it’s only bad when you can’t afford to pay the debt back or if paying your debt back causes financial hardship to you and your family. The decision to take out a loan should only be made if you know where the money to pay off your monthly instalments is going to come from and if you are willing to commit yourself to make repayments on time and in full for the duration of your loan.

The amount you may need to take out sometimes depends on where you are in the country. For home improvement loans, London borrowers will generally pay more than borrowers wanting home improvement loans in Scotland. Always make sure you get the cheapest quote from any tradesman and you shop around for the best finance deal.

Compare Loans in the UK – How Can LoanTube Help?

LoanTube is here to make borrowers’ lives easier by matching them up with the finance companies who actually want to lend them money. By approaching the problem of finding the right lender for the right borrower in this way, we save everybody time and money.

The whole process takes seconds – let us show you the very best deal we’ve found together with all of the small print explained in such a way that you don’t need to be an international lawyer to understand it!

You’re under no obligation to take out a loan we’ve found for you from our panel of lenders and our service is completely free of charge. To find out the types of loans we can help you with, please click here.

To start your application with LoanTube, click here.