COVID-19 has started weighing on us. It’s hitting us hard on our finances and organizing it after redundancy or a sudden decrease in income can be challenging. Although the situation is quite panicky, it demands planning and awareness. The first move is to be aware of your finances. Prepare a budget according to the income and your monthly outgoings. The major chunk of your income may go towards your mortgage or rent. Also, check your insurance protection policies. Some of the policies also cover the cost in the event of redundancy.

There is a range of scheme that can help, but you should know which scheme will suit you the best. Next, find out your eligibility for that particular benefit.

Maximise your options: Compare and apply for loans below with LoanTube

Apply Filters

In this blog, we will discuss:

- What is Universal Credit? How does it work?

- Who can claim Universal Credit?

- How much can you get through Universal Credit?

- How long does it take to get the benefit?

- Universal Credit scams and how to protect yourself?

- How to apply for Universal Credit?

What is Universal Credit? How does it work?

Universal Credit is a benefit that is designed for people who are on a low or reduced income. It replaces 6 benefits with a single monthly payment. Listed below are the 6 benefits that are replaced by it:

- Working tax credit

- Income support

- Child tax credit

- Housing benefit

- Income-based jobseeker’s allowance

- Income-related employment and support allowance

So, instead of getting multiple benefits, you will be entitled to only one monthly payment. That only monthly payment will help you to cover your monthly expenses. Even if you apply for Universal Credit with your partner, both of you will get only 1 payment. You can also get extra payments but that depends on your circumstances.

You may get extra payments if you:

- Are looking after 1 or more children

- Are disabled and have health conditions

- Need help with paying for your housing costs

- Work and pay for childcare

- Have a child who has a disability

You can make the Universal Credit claim online and it is paid in arrears, so it may take some time after you claim your first payment. Also, if you have a partner, and you both have applied for a Universal Credit, you will get a joint payment in a single bank account.

Learn more about the changes in Universal Credit.

Who can claim Universal Credit?

To be able to get the benefits from this scheme, there are certain eligibility criteria that you must qualify. One of the most basic qualifying criteria will be if you are on a low income or you are out of work. Further, you may claim it if:

- You are 18 years of age or above.

- You are a legal citizen of the United Kingdom.

- You have lost your job or your pay has reduced.

- You or your partner with who you are applying are under state pension age.

- The childcare cost is expensive.

- You are finding it difficult to pay your bills.

- Your savings are less than £16,000.

If you are living with your partner, their financials will be taken into consideration while assessing your claim for the benefit. Moreover, if you have more than £6,000 in savings but less than £16,000, you may get less in Universal Credit.

You can claim Universal Credit even if you are not 18 years of age or above. However, this comes with a different set of rules and eligibility criteria.

How much can you get through Universal Credit?

Generally, Universal Credit has two components – basic allowance and additional payments that cover costs such as housing, childcare, or to cover illness and disability. The amount that you can claim through Universal Credit depends on a few factors such as:

- Pension

- Savings and capital

- Employment status

- Other benefits that you are already using

There is a cap on the amount that you can take through this benefit. But if you are working or have a disability, there is no cap.

| Applicant Status | Age | Amount |

|---|---|---|

| Single | Under 25 | £342.72 |

| Single | 25 or over | £408.89 |

| Joint | Under 25 | £488.59 |

| Joint | 25 or above | £594.04 |

- Couples and lone parents living in London can get £1,916.67 per month.

- Couples and lone parents living outside London can get £1,666.67 per month.

- If you are single, do not have any children and you live in London, you can get £1,284.17 per month.

- If you are single, do not have any children and you live outside London, you can get £1,116.67 per month.

How long does it take to get the benefit?

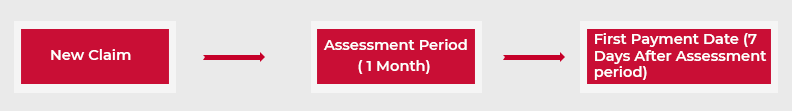

When you apply for a Universal Credit, your application will be assessed thoroughly before giving any decision. Generally, it takes 1 calendar month for the assessment. You will receive the first payment 7 days after the assessment. You will get the money in your bank account on the same day every month. If the payment date is on a weekend or there is a bank holiday, you can expect to get paid 1 day earlier. There is a slight change in the rule if you live in Scotland. You will be asked if you want to be paid once or twice a month after your first payment.

Universal Credit scams and how to protect yourself?

Whether you are borrowing a personal loan, or you are using your credit card online to make a payment – be aware of scammers. Cybercriminals have not taken a backseat when it comes to Universal Credit. Recently, fraudsters had been reported to share tutorials on the dark web that taught how to score quick cash through Universal Credit. The tutorials cost up to £120. Scammers targeted individuals who were seeking advance payment feature of Universal Credit. It takes 5 weeks for the Department of Work and Pensions (DWP) to assess a claimant’s application.

There are various ways scammers can contact individuals and hence, claimants need to be aware of who they are dealing with. Fraudsters may also contact through social media platforms, direct messages and advertisements.

How to protect yourself from fraudulent calls/approach?

Identifying the signs that you are dealing with a fraudster is extremely important to protect your finances. Here are a few ways through which you can spot a scammer:

- Scammers will often ask you to share your personal information including log-in credentials. Such details shouldn’t be shared at any cost.

- If you have been contacted by someone through a social media platform, report them immediately as most of these platforms have reporting tools.

- Apply for a claim directly for yourself rather than asking someone else to apply for it on your behalf.

- Fraudsters may also ask you to pay an advance fee to process your benefit application. But remember, you do not require to pay anything to apply for a Universal Credit.

How to apply for Universal Credit?

You can directly apply for Universal Credit online and in some cases, you may also need to book an interview at Jobcentre Plus. After you apply for the benefit, you will be told to book the interview if only required. Check the eligibility before you apply so that you know where do you stand in the entire process. Reach out to Universal Credit helpline if you need any sort of help.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]