A home equity loan is one where you can use a portion of your equity on your home to borrow a loan in instalment. It can be helpful for you to repay your existing debts using an equity loan. You may also choose to refinance your current loan or manage the expenses of an emergency. So, it can be said that you are tapping onto your home’s worth to pay for other expenses. A home equity loan puts your home at risk if you do not repay debt. If you are considering borrowing a home equity loan it’s important to understand how this works and the risk that you will have to take.

Maximise your options: Compare and apply for loans below with LoanTube

Apply Filters

What is a home equity loan?

- A home equity loan is also known as a second mortgage. It is a form of secured loan as a borrower uses their house as collateral. It allows you to borrow money in a lump sum and repay in fixed monthly instalment including the principal amount.

- But what is equity? Equity is an amount that you get after subtracting the current market value of your property from the amount that you owe on your mortgage. The more you keep repaying your mortgage, the more become equity on your property.

- There are 2 types of equity loans – fixed-rate loans, and Home Equity Lines of Credit, otherwise known as HELOCs. A typical repayment period ranges from 5 to 30 years. HELOC is a revolving credit line that works differently. With a HELOC, you will have to pay the interest on the amount that you have used and not on the unused amount of the credit line.

How much equity do I have?

- It is a simple calculation that doesn’t involve any complex formulas. You just have to subtract the amount that you owe on your mortgage from the current market value of the property.

- Let us take an example of how to calculate the equity of your home.

- You have purchased a home for £525,000 and its current market value is £550,000. You have been consistently paying your monthly mortgage payments and £250,000 is left to be paid. Then the equity that you have in the home is £300,000.

How does an equity loan work?

- A home equity loan allows you access to a lump sum amount of money. This form of borrowing works best if you know how much money you need and for what exactly you need it. Once you borrow a home equity loan, you’ll have to repay it at a fixed rate for a specified period of years.

- Ensure that you can afford to make payments on this second mortgage in addition to your main mortgage while maintaining a smooth balance between your other monthly expenses.

How much can I borrow with a home equity loan?

Lenders may typically allow you to borrow somewhere around 70% to 90% of the value of your property minus the amount of mortgage that you owe. The amount of interest that will be charged depends on your credit history and current income.

What is the eligibility criteria of an equity loan?

Although you are using the available equity on your home to borrow money by using it as collateral, you will still have to qualify for the loan. The lending criteria may vary by lenders but your relationship with credit will play a vital role in the approval of your loan application.

You will need to have a fair credit score to be eligible for a home equity loan. Most of the lenders will also assess other information such as:

- Your income

- Debt-to-income ratio

- Available equity on your home

- Current employment or source of earning

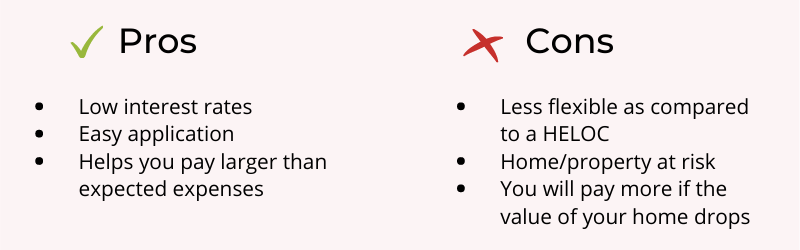

What are the advantages & disadvantages of a home equity loan?

- Everything has some advantages and disadvantages. Some products may work for a set of people while the same product may not work for a different group of people. That is because of individual circumstances. Getting a home equity loan for homeowners is easy and as it is a secured loan, they may get a lower rate of interest on the loan.

- However, you shouldn’t make the decision of risking your home only because of a lower interest rate. Carefully weigh your options and consider the pros and cons of this product before making your decision.

Are home equity loans a good idea?

- Whether a home equity loan is a good idea or not depends on your financial circumstances and your affordability. We have already discussed the risk that is involved in borrowing a home equity loan. If you cannot manage the repayments, the lender may repossess your home/property and sell it to recover the money you owe to them.

- It’s worth taking the risk if you can manage all the repayments efficiently. If you are paying high interest on your existing debts, then a home equity loan with a low-interest rate may help you save hundreds or thousands of pounds. But you should be cautious while gauging your options.

- Failing to repay the loan will cause financial havoc and it may leave a striking dent in your finances for a long time.

What are the alternatives to a home equity loan?

If you are not ready to borrow a home equity loan, you may consider some alternatives to help you access the funds that you need. Listed below are a few viable options that are worth taking into account before making your decision.

1. Consider refinancing

- You may refinance your personal loan to get a new one with a lower interest rate. Refinancing a loan will help you save money and the percentage of risk involved in it is quite low. The best thing about it is you may find a lender with a payment holiday offer. If you think you need a break from the repayments, it’s certainly a good option to check out.

Read more about refinancing a personal loan here.

2. Debt consolidation loan

- A debt consolidation loan is an unsecured loan and it can help you to track and maintain your budget while allowing you to repay the loan on time. In simpler words, all your debts are combined into a single one. So, instead of repaying multiple loans, you will have to pay a single one. You may also save money with this option if you manage to find a consolidation loan with an interest rate lower than the combined interest rate of all your existing debts.

3. Use HELOC

- If you do not need a large amount of money, you can use a HELOC. They are much like credit cards. It is secured to your home and gives you a revolving credit line. You will not have to pay any interest on the amount of money that you have not used. These loans come with a floating rate of interest.

- The value of your home may increase or decrease depending on the housing market and real estate trends. And with a decrease in the value of your property, the equity will also decrease. You can increase the value of your property by making improvements to it.

- Before you decide to use your property for borrowing a loan, consider the alternatives that are available to you. And if you are still not sure, contact an expert who may guide you the right way. Because taking out a loan while putting your home at stake is a huge risk. Think about ways that will minimise this risk. And if you still want to borrow a home equity loan, compare different rates to choose the best one. Do not apply for a loan if your credit score is not fair. Take some time and work on improving your score before you can apply to get a loan at a low-interest rate.