Simply said, a debt-to-income ratio shows the percentage of your monthly income that goes toward repaying the debts that you have. Keeping the ratio balanced is the key to maintain good financial health. So, how does it help you with managing your debts? Delve deeper into this for a quick understanding of your finances. ⭐Debt Management ⭐Financial Tips

Personal loans and credit cards are two such financial products that we use most often. When people apply for any loan, a few applications get accepted while a few get rejected. Several reasons affect the chances of approval of your application. A debt-to-income ratio plays an important role in your loan application. It is one of the factors that lenders or financial institutions take into their account when assessing your application. Debt-to-Income ratio, also known as DTI is as essential as your credit score.

In this blog, we will discuss:

- What is a debt-to-income ratio?

- How to calculate debt-to-income ratio?

- What is a good ratio?

- How does a DTI affect your score?

- How to improve your ratio?

Maximise your options: Compare and apply for loans below with LoanTube

Apply Filters

What is a debt-to-income ratio?

- It is a value in the form of a ratio of what you earn and how much you pay towards debt every month. It is important to note that it is measured on an individual’s monthly gross income. That means the amount that you earn before paying your taxes and other deductions. The repayments will include your monthly credit card payments, housing expenses, property taxes, homeowner association fees, investment loans, car loans, insurance and any other form of debt. Regular utility bills, subscription services, mobile phone contracts are not counted as debts and hence, these expenses are not included in your debt-to-income ratio.

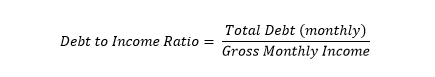

How to calculate debt-to-income ratio?

Calculating your DTI is easy and it doesn’t involve any complex mathematical formula. Divide your total monthly debt by your gross monthly income. Multiply the final amount that you receive after dividing the total debt by gross monthly income to convert the ratio into a percentage.

Let us take an example.

Your Debts:

- A proposed mortgage of £800 per month

- Credit card minimum payment of £200

- Car lease total £300 per month

- Overdraft of £1000, interest and fees approx. £50 per month. Monthly debt set to £80.

Your Income:

- Regular salary of £40,000 p.a., converts to £3,333.33 monthly

- Child benefit for one child: £89 per month

Total debt: £1,380

Total income: £3,422.33

DTI ratio: 40.32%

What is a good debt-to-income ratio?

The debt-to-income ratio must be below 43% if you want to get qualified for a mortgage. The lower your DTI, the better and easier for you to get your loan application approved. A low DTI ratio means you have sufficient income to service your current debts. This makes your profile favourable to the lender. Also, there are two types of debt-to-income ratios:

-

Front-end ratio

It is also known as a household ratio. It takes the amount that goes toward your housing expenses that include mortgage payments, property taxes, insurance.

-

Back-end ratio

And this ratio includes all other debts that you service each month such as credit card payments, personal loans, car loans, student loans, and also housing.

Most of the lenders prefer to the back-end ratio for loans issued by banks or private mortgage lenders. So, if you are applying for a mortgage, lenders may consider both the ratios. But it also varies from lender to lender.

Ideally, you should keep both the ratios as low as possible.

How does a DTI affect your credit score?

Not everything goes into your credit report. A credit report doesn’t include your income, and hence, your debt-to-income ratio doesn’t have a direct impact on your score. However, the debt that you owe is reported to the credit bureaus. And that debt may impact your credit score. It can be said that not the entire ratio impacts your score, but debt does leave a dent on it. Here are a few ways the debt owed by you can harm your credit score:

- Types of credit you are currently using.

- The total amount of debt that you owe.

- Age of all the loans you are holding.

- The number of credit checks on your profile.

- Your repayment or debt servicing behaviour.

While the debt-to-income ratio is not used to measure your credit score, you have to maintain it. Remember that every lender has a different stance on what they accept or reject. But if your DTI is high, it may get difficult for you to find a lender who will approve your loan application.

How to improve your debt-to-income ratio?

The struggle for getting your loan application accepted gets tough if you have a high DTI. To make your financial life easier, you need to lower your DTI. There are various ways that you may implement to lower your score:

1. Increase your monthly repayment amount

- If you start making extra payments, you will get rid of the debt sooner than estimated. This will help you in lowering the overall debt amount that you pay each month. But be careful as making extra repayments every month requires a solid financial plan. Go for it only if you have enough income or savings to fall back on.

2. Avoid taking on more debt

- Do not apply for new loans or credit cards if you already have a high DTI. Adding new loans to your bucket will increase your DTI – which is not healthy for your personal finance. Also, try not to use your credit cards as it will increase your monthly repayment amount.

3. Postpone buying any big-ticket item

- If you are planning to buy or fund any big-ticket item such as a car, a home – postpone it. Avoid making any purchase on debt as it will help you in lowering the ratio. Once you have paid off a significant chunk of your debt, you may consider going for a new loan for any large purchase.

- Keeping your debt-to-income ratio low will ensure that you can manage your debt repayments. It will also give you the peace of mind that comes from responsibly managing your finances. Moreover, you will be more likely to be approved for credit in the future.

- Banks and other lenders evaluate how much debt can be accumulated by their clients before they start experiencing financial problems. They use this result to analyse loan amounts and interest rates that can be offered to a borrower. Although the recommended DTI varies from lender to lender, it is generally about 36%. It’s not just borrowers who will benefit from calculating your debt-to-income ratio. It can be a useful way to assess the need to improve your finances before applying for a loan or mortgage. When you realize that the ratio is greater than expected, you may choose to lower the loans or raise your salary – or both – to improve the odds of being approved for a personal loan before you apply.